In-House Payroll vs Outsourced Payroll: Pros, Cons, and Xero Benefits

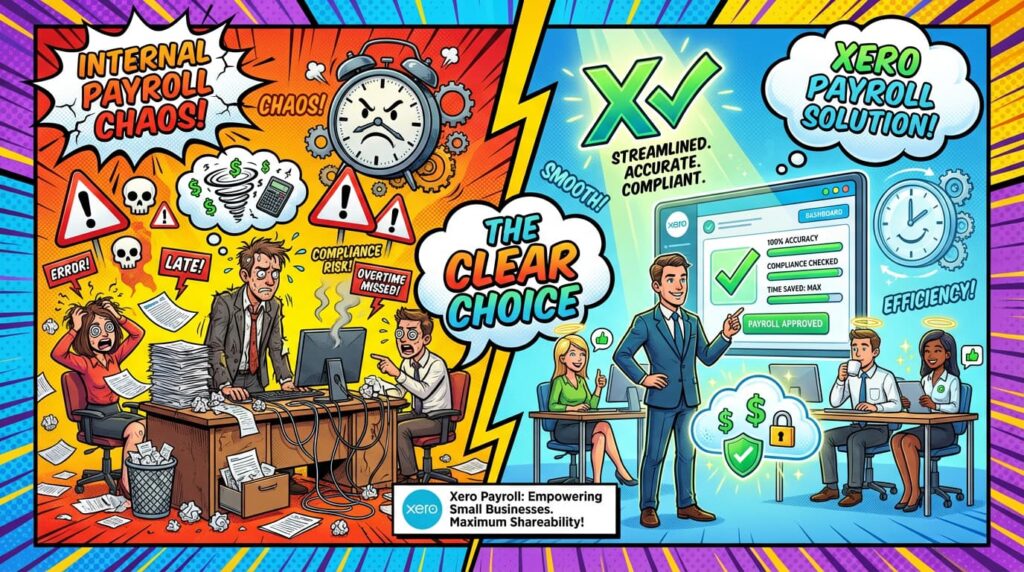

Payroll mistakes drain time and confidence—leaving owners juggling deadlines, compliance, and stress; choosing outsourced payroll vs in-house becomes pivotal, shaping clarity and control ahead.

Most small businesses don’t start with a payroll plan. They start with trust. A notebook. A spreadsheet. A hope that things will “work out.”

Until payday arrives—and everything suddenly feels heavier.

There’s a familiar story shared by a café owner I once worked with. She handled payroll herself because “it’s just a few staff.” One missed super payment turned into a warning letter. One miscalculated public holiday rate upset a long-term employee. None of it was intentional. It was simply too much for one person to manage while running a full business.

And she’s not alone. According to the OECD, payroll compliance remains one of the highest administrative burdens for SMEs globally. The rules shift. Awards change. Rates adjust. Penalties multiply. Owners often realise this only when something goes wrong.

Yet payroll is more than numbers. It’s trust, fairness, and legal responsibility woven into one small weekly ritual.

This is why understanding the difference between outsourced payroll vs in-house isn’t a technical decision—it’s a leadership one. And it’s why tools like Xero Payroll have become part of the new backbone supporting modern SMEs.

Before we explore the pros, cons, and real-world impact, here’s a quick snapshot.

- In-house payroll offers direct control but carries rising compliance risks for SMEs.

- Outsourcing adds expertise and accuracy, reducing admin load and potential penalties.

- Xero Payroll supports both models, improving visibility, automation, and compliance.

- The right choice depends on team size, complexity, risk tolerance, and growth plans.

In-House Payroll: Where Control Meets Pressure

Managing payroll internally gives owners a sense of closeness to their numbers. It feels safe because it’s “right there,” stored in spreadsheets or inside accounting software.

Read more: Payroll Management & Optimization

- Cash Flow Risks from Poor Payroll Management and How to Fix Them

- Employee Payment Errors: Why They Happen and How Xero Fixes Them

- Xero Payroll vs Other Payroll Software: Which is Best for SMEs?

- In-House Payroll vs Outsourced Payroll: Pros, Cons, and Xero Benefits

- Cost of Payroll Errors vs Investing in Payroll Services

- Why SMEs Choose Xero Payroll Over Manual Accounting

- Monthly Payroll Checklist for Small Businesses Using Xero

- 7 Payroll Reports Every SME Should Track in Xero

- Automated Payroll Tasks You Can Implement in 30 Minutes

Features in practice

In-house payroll means you directly calculate wages, overtime, superannuation, leave, and tax. You manage timesheets, staff changes, compliance updates, and reporting.

Benefits

You keep visibility. You can check figures anytime. Sensitive data stays within the business. It suits micro-teams or owners who already understand payroll.

Where SMEs use it

- Freelancers or agencies with 1–3 contractors

- Retail shops with stable staff rosters

- Family-run operations

- Early-stage startups with simple pay structures

A typical day

Wednesday afternoon—payrun day. You update hours, double-check public holiday penalties, lodge STP, adjust leave balances, and send payslips. It feels manageable when nothing changes.

But small changes stack up. A new award rule. A fluctuating roster. A team member switching from casual to part-time.

Expert insight grounded in real SME patterns

In many small businesses, payroll responsibility falls to someone who never sought the role—often a founder or admin lead already juggling multiple tasks. The accuracy of payroll depends not on expertise, but on the availability of one overloaded person.

Risks when ignored

Errors go unnoticed. STP reports get delayed. Award changes slip through. These can lead to penalties or employee disputes—two of the most emotionally draining issues for any business.

Old way: spreadsheets, manual checks, and long nights recalculating entitlements.

New way: software assistance—like Xero—automating calculations and keeping compliance up to date.

This sets the stage for a deeper look at outsourcing.

Outsourced Payroll: Relief, Accuracy, and Shared Responsibility

Outsourcing isn’t about giving something up. It’s about gaining space. For many SMEs, outsourcing payroll opens room to think, plan, and grow.

Features in practice

A payroll specialist manages payruns, compliance, reporting, super, onboarding, and year-end tasks. They stay updated on regulation changes so you don’t have to.

Benefits

- Reduces risk of compliance mistakes

- Saves time each pay cycle

- Offers peace of mind and accuracy

- Frees owners from admin-heavy work

Industries that benefit most

- Hospitality and retail with complex rosters

- Trades managing job-by-job hours

- Healthcare with shift penalties

- Agencies with contractors and variable pay cycles

- Growing startups shifting from ad-hoc to structured operations

A growing marketing agency moves from 5 to 15 employees. Pay structures become varied, leave policies expand, and onboarding increases. Outsourcing gives them a smoother rhythm and fewer internal bottlenecks.

Outsourced payroll works best when communication is clear and deadlines are respected. Most issues arise not from errors, but from last-minute changes or delayed employee updates.

A poorly managed outsource partner can cause frustration. Missing information leads to incorrect payruns. Lack of visibility can make owners anxious if they don’t have access to live data.

Old way: emailing spreadsheets, relying on one bookkeeper, hoping nothing gets missed.

New way: outsourcing supported by real-time tools like Xero, where both the business and the provider share a single source of truth.

This leads naturally to where Xero fits in.

Where Xero Payroll Enhances Both Models

Xero doesn’t replace your payroll choice—it strengthens it. Whether you keep payroll in-house or outsource, Xero provides accuracy, automation, and compliance support.

Features that matter

- Automated super calculations

- STP Phase 2 lodgements

- Award-category support

- Employee self-service

- Timesheets and leave tracking

- Integration with rostering tools

- Real-time payrun overview

Practical benefits

- Fewer manual calculations

- Reduced errors in weekly or fortnightly payruns

- Clear audit trails

- Better communication with staff

- Consistent compliance alignment (critical for SMEs)

Read more: Cloud Payroll & Strategic Insights

- How Cloud Payroll Services Improve Accuracy, Efficiency, and Compliance

- The Role of Payroll Data in Strategic Business Decisions

- Why SMEs Are Moving to Cloud-Based Payroll Services

Use cases across industries

- Hospitality: syncing staff hours from rostering apps

- Creative agencies: contractor payments and PAYG workflows

- Retail: shift penalties and weekend rates

- Trades: job-specific timesheets

- Nonprofits: grant-aligned reporting

A landscaping company owner once said, “Switching to Xero Payroll felt like turning a cluttered drawer into a labelled cabinet.” That’s the clarity fast-growing SMEs often crave.

When payroll moves into Xero—whether managed internally or by a payroll partner—owners regain confidence. Data becomes visible, predictable, and less dependent on memory or manual checks.

Trying to scale without automation often leads to delayed super, messy year-end reporting, and errors that could have been avoided with better systems.

And once the foundation is modernised, the next question becomes: which model—outsourced or in-house—fits your future?

In-House vs Outsourced Payroll: A Practical Comparison

| Factor | In-House Payroll | Outsourced Payroll |

|---|---|---|

| Control | High | Medium |

| Expertise Required | Moderate–High | Low |

| Compliance Risk | Higher | Lower |

| Time Required | High | Low |

| Cost | Lower for micro-teams | Better value for growing teams |

| Scalability | Limited | Strong |

| Suitable For | Micro-businesses | SMEs with complexity or growth |

Common Mistakes SMEs Make

- Assuming payroll is “simple” because the team is small

- Using spreadsheets beyond their limit

- Relying on one overworked staff member

- Ignoring compliance updates

- Switching models too late—after errors occur

Checklist for Deciding Your Payroll Path

- Do you have time to manage payroll consistently?

- Are your pay rules simple or complex?

- Do you want internal control or external support?

- Are you confident with compliance updates?

- Is your business scaling in the next 12–18 months?

If several answers lean toward support, expertise, or growth—outsourcing combined with Xero often provides the most reliable path.

Read more: Payroll Compliance & Mistakes

- Top 5 Payroll Mistakes Small Businesses Make and How Xero Solves Them

- Payroll Compliance Nightmares and How Xero Prevents Them

- Common Payroll Mistakes SMEs Make and How to Avoid Them

Conclusion

Payroll shapes how your team trusts you and how your business shows up financially. Whether you keep it in-house or outsource it, the goal is the same: accuracy, confidence, and compliance without overwhelm.

With a strong platform like Xero, both paths become clearer. The right choice depends on the season your business is in—and the direction you’re heading next.

For SMEs ready to minimise payroll stress and improve accuracy, we help set up the right structure and streamline everything through Xero—so your team gets paid correctly and your business stays compliant.